Navigating the No Surprises Act: Ensuring Price Transparency and Compliance

The No Surprises Act, enacted in December 2020 and effective since January 2022, is all about creating clarity at a moment that matters to both patients and practices. For patients, it means no more unexpected bills that leave them frustrated. For practices, it means a clearer way to manage billing, protect revenue, and build trust with the people they care for.

As we step into 2025, this law isn’t just about compliance—it’s about simplifying complexities for your practice and giving patients a financial experience that’s as straightforward as the care you provide. In this, we’ll explore what the act means for your practice, why processes like eligibility checks, verification, and cost estimation are crucial, and how you can turn compliance into an opportunity to strengthen patient relationships.

Pressed for time? That’s okay—just jump to the bottom of this article to connect with us at CERTIFY Health. We’ll guide you through it all, so you can focus on what matters most: growing your practice and delivering great care. Alright, let’s begin with addressing the elephant in the room.

What is the No Surprises Act?

The No-Surprise Act was created to address this issue, protecting patients from unexpected costs. But for practices like yours, this new law brings both opportunities and challenges in managing Insurance Eligibility, Insurance Verification, and Insurance Estimation.

These processes are crucial not only for compliance with the law but for ensuring that your patients know exactly what they’re responsible for paying—before they even leave your office. So, let’s break it down: Why are these processes so important, and how do they help prevent Balance Billing in independent and urgent care settings?

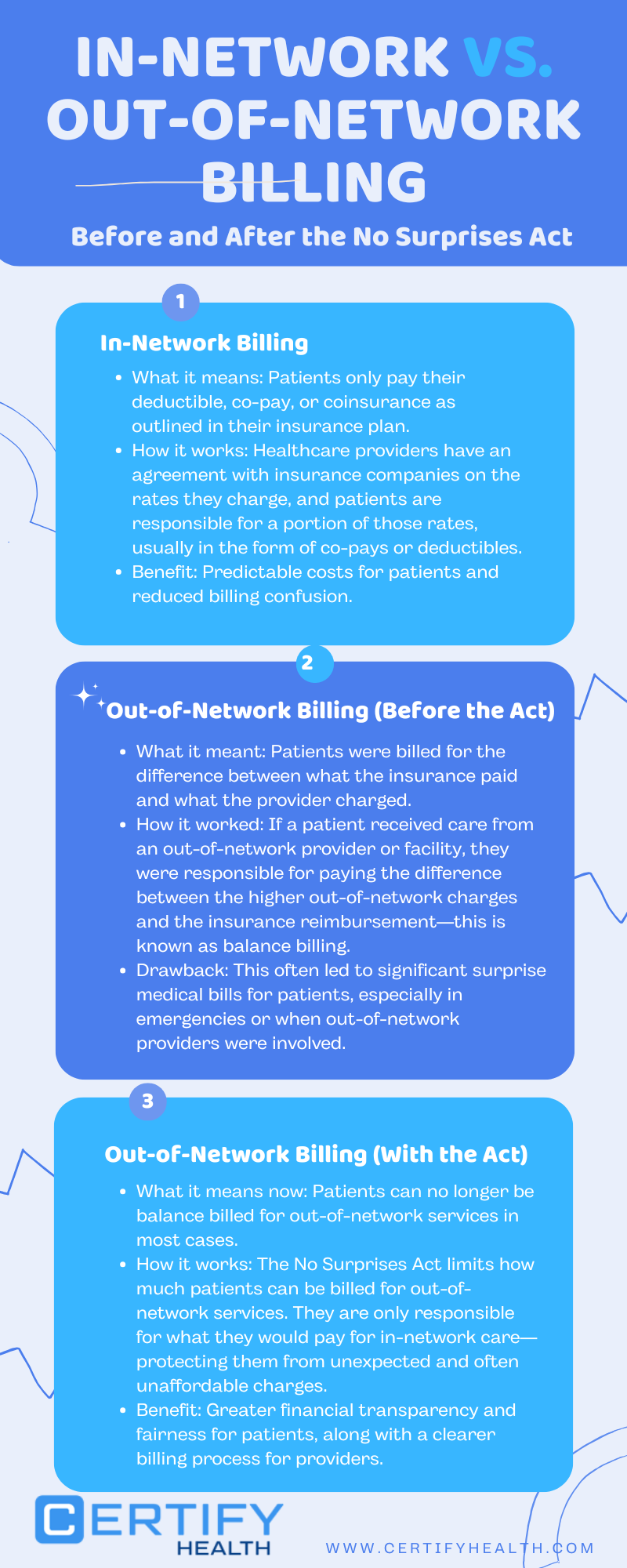

To understand the true impact of the No Surprises Act, let’s take a closer look at how in-network and out-of-network billing has changed under this legislation.

What is the Rule of No Surprises?

The rule of No Surprises is the heart of this legislation. It ensures that patients are protected from being charged more than the in-network cost for out-of-network services under specific circumstances.

Here’s what it covers:

- Emergency Services: Patients cannot be balance billed, regardless of whether the provider or facility is in-network or not.

- Non-Emergency Services: At in-network facilities, out-of-network providers must follow in-network cost-sharing rules, meaning patients can’t be charged beyond what they’d pay for an in-network provider.

- Good-Faith Estimates: Patients must be informed of their estimated costs upfront, giving them a clear understanding of what they owe before care is provided.

For practices, this rule emphasizes the importance of clear communication and accurate cost estimations. It’s not just about avoiding penalties—it’s about offering a seamless, patient-friendly experience while ensuring your revenue processes are compliant and streamlined.

Let’s dig this a little deeper.

Was the No Surprises Act Passed?

Yes, the No Surprises Act was enacted as part of the Consolidated Appropriations Act of 2021, passed by Congress and signed into law by then-President Donald Trump in December 2020. The Act officially took effect on January 1, 2022.

Its purpose is clear: to protect patients from unexpected medical bills while providing practices with a framework to ensure transparency and compliance. Overseen by the Centers for Medicare & Medicaid Services (CMS), the law continues to guide practices in 2025 as they refine processes for insurance eligibility, verification, and cost estimation.

What Is Balance Billing and Why Does It Matter for Independent Practices?

Balance billing happens when a healthcare provider bills the patient for the difference between what the insurance pays and what the provider charges, typically in cases where the provider is out-of-network. It’s a common issue in emergency care, but it’s something that can affect non-emergency services in independent physician practices and urgent care settings too. In these scenarios, if a provider is out-of-network, the patient could be stuck with a bill for the difference—something they likely weren’t expecting.

Here’s the tricky part: Balance billing is prohibited under the No-Surprise Act for most emergency services and non-emergency services provided by out-of-network providers at in-network facilities. But for independent physician practices and urgent care centers that operate outside of hospital networks, the rules around balance billing can feel a bit murkier.

In your practice, if a patient receives care from an out-of-network provider or facility, and they don’t have the right information upfront, it could lead to these surprise bills. The No-Surprise Act requires that patients be given accurate, clear estimates of their costs before they receive care—especially when they’re dealing with non-emergency, out-of-network services. The law also mandates that they can’t be billed more than what they would owe if the provider were in-network.

That’s why Insurance Eligibility, Verification, and Estimation are more important than ever.

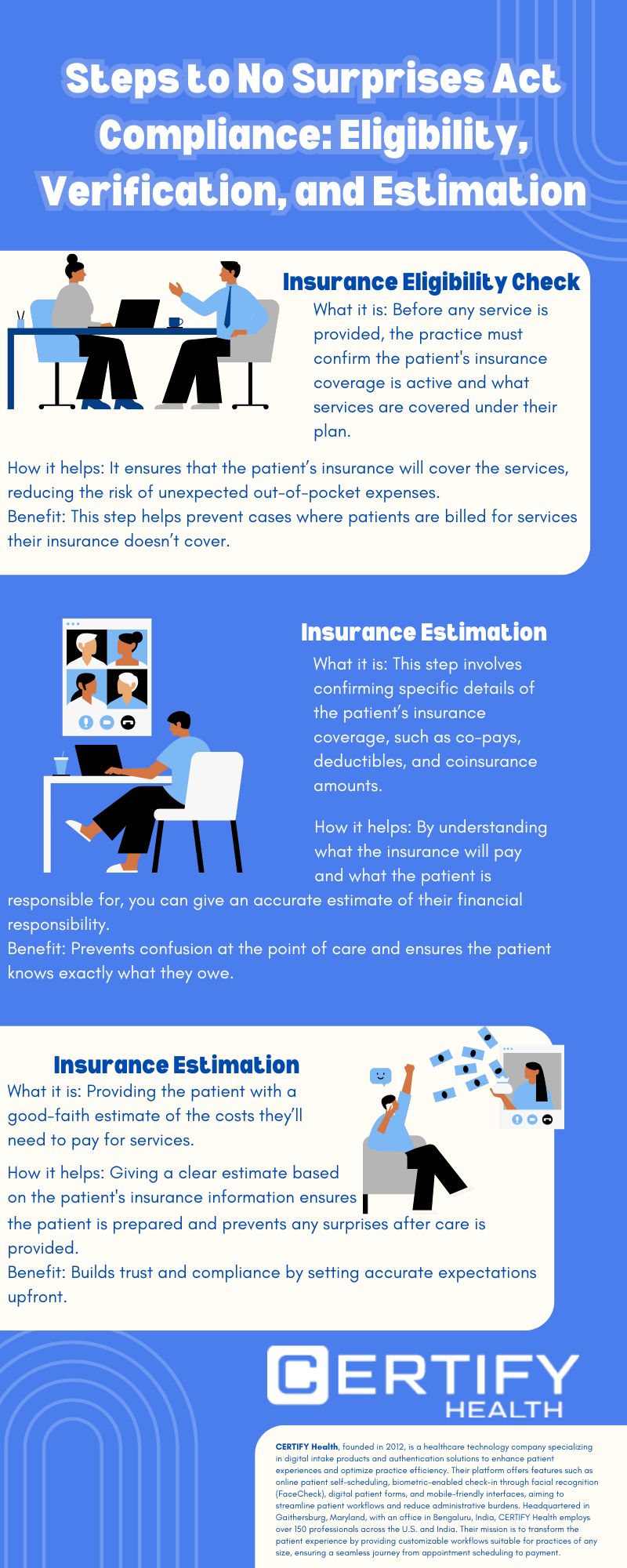

Insurance Eligibility: The First Line of Defense

Before anything else, you need to know whether the patient’s insurance is valid and active. Think of Insurance Eligibility as the first line of defense against surprise bills. By verifying whether the patient’s plan covers the service they’re seeking, you can avoid scenarios where a patient walks into your practice and is later surprised to find out their coverage doesn’t extend to certain services.

For independent physician practices and urgent care centers, eligibility checks help you figure out if the insurance provider will cover the cost of the services your patient needs. If a patient’s insurance doesn’t cover the service or isn’t active, you can catch that issue early and help guide them through alternative payment options or direct them to an appropriate course of action. This simple step can prevent balance billing headaches down the line.

Learn how to boost your practice’s revenue by exploring our insights on Medical Insurance Eligibility Software.

Insurance Verification: Making Sure You Have the Full Picture

Now, it’s time for Insurance Verification. Once you’ve confirmed that the patient’s insurance is active, you need to verify the specific details: what’s covered, what isn’t, and what the patient’s out-of-pocket costs might be. This step is crucial because co-pays, deductibles, and coinsurance can differ depending on the plan. For example, an urgent care visit might be covered, but certain tests or procedures might not be.

Verifying all this information allows you to give the patient an accurate picture of what they will owe at the time of service, thus minimizing the risk of a balance billing scenario. If there’s a mismatch or confusion between what the patient expects and what’s actually covered, you can clarify things in advance, so there are no surprises later.

For a deeper dive into the latest tools enhancing insurance verification, check out our article on 7 Top Insurance Verification Software Transforming Healthcare in 2025.

At CERTIFY Health, we specialize in providing accurate insurance estimations to enhance patient trust. Connect with us to learn how our solutions can benefit your practice.

Insurance Estimation: Giving Patients a Clear Financial Picture

After eligibility and verification, it’s time for Insurance Estimation. This is where you can really shine. By providing your patients with a good-faith estimate of what they will owe, you not only stay compliant with the No-Surprise Act but also help build trust with your patients. With urgent care centers and independent practices seeing patients with varying insurance plans and needs, offering an estimate that is both accurate and transparent is key to fostering positive relationships.

Your estimate will factor in what the insurance will pay and what the patient’s responsibility will be, whether it’s a co-pay, deductible, or coinsurance. In many cases, you might need to help patients understand how certain charges—like out-of-network services—might affect their overall bill. If you can give them a clear and accurate estimate upfront, you’re taking a huge step in preventing any balance billing.

Bringing it all together, here’s a step-by-step process to ensure compliance with the No Surprises Act and simplify billing for both your practice and your patients.

How These Processes Work Together to Protect Against Balance Billing

When these processes—eligibility, verification, and estimation—work together, you not only help your practice stay compliant with the No-Surprise Act, but you also protect your patients from unexpected out-of-pocket costs. Here’s a quick rundown of how it all fits together:

- Eligibility confirms that the patient’s insurance is valid and which services are covered.

- Verification ensures you have the correct details about the patient’s co-pays, deductibles, and coverage limits.

- Estimation gives the patient an accurate picture of their financial responsibility, reducing confusion and frustration.

These steps allow you to avoid balance billing, stay transparent with your patients, and keep them satisfied with their experience at your practice.

Ensure compliance and patient satisfaction with CERTIFY Health’s comprehensive insurance verification services. Discover more.

Why It’s So Important for Independent Practices and Urgent Care Centers

Who Does the No Surprises Act Apply To?

The No Surprises Act isn’t just about hospitals or large healthcare systems—it applies to a range of scenarios designed to protect patients from unexpected costs while ensuring practices have a clear path to compliance. Here’s how it breaks down:

- Emergency Services: No matter where the care is provided, patients can’t be balance billed for emergency services—even if the provider or facility is out-of-network.

- Non-Emergency Services at In-Network Facilities: If out-of-network providers deliver care at in-network facilities, patients are still protected. They’re only responsible for in-network cost-sharing amounts, nothing more.

- Mental Health Services: The Act also extends protections to mental health providers in certain cases, ensuring patients receive clear and transparent billing no matter the care setting.

For practices, this means focusing on clear processes for eligibility verification and cost estimation to meet these requirements and avoid billing disputes. It’s not just about compliance—it’s about showing patients you value transparency.

Transform your practice’s billing processes with CERTIFY Health’s innovative solutions. Get in touch to see how we can assist you.

What are the Key Points of the No Surprises Act?

Let’s break down the essentials of the No Surprises Act. It’s designed to protect patients and bring transparency to healthcare costs while making compliance straightforward for practices like yours.

Now, here’s what you need to know:

- Balance Billing Prohibition: Patients can’t be balance billed for emergency services or non-emergency services provided by out-of-network providers at in-network facilities. This is to ensure patients aren’t caught off guard by unexpected charges.

- Good-Faith Cost Estimates: Providers are now required to share clear, detailed cost estimates with patients before care is delivered, eliminating any financial surprises.

- Independent Dispute Resolution (IDR) Process: When billing disagreements arise, providers and insurers can resolve them through a federal arbitration process—keeping patients out of the middle.

- Transparency in Coverage: Patients must be informed about their insurance coverage, including network status and cost-sharing details, so they know exactly what to expect.

These key points aren’t just about compliance—they’re about building trust with your patients and creating a billing experience that’s as transparent as the care you provide.

For more insights, check out the ACEP overview of the No Surprises Act.

Insights:

Key Takeaways from the No Surprises Act The No Surprises Act protects patients from unexpected bills, requires good-faith cost estimates, resolves disputes through arbitration, and prioritizes transparency in healthcare coverage. For more details, visit the ACEP overview.

Does the No Surprises Act Apply to Physician Offices?

For physician offices, the applicability of the No Surprises Act can seem less straightforward compared to hospital-based services. However, the Act does apply in specific scenarios, particularly when non-emergency and out-of-network services are involved.

According to CMS, if a physician office provides out-of-network services in a manner that triggers surprise billing, the Act’s protections come into play. This includes scenarios where a patient has limited visibility into their network options beforehand.

The AMA highlights the importance of proactive measures, such as verifying insurance eligibility and providing detailed cost estimates, to ensure compliance and avoid disputes. For practices, this means integrating robust systems for insurance verification and cost estimation, ensuring patients have a clear understanding of their financial responsibility before receiving care.

Adhering to these guidelines, physician offices not only comply with the Act but you also enhance patient trust by offering transparency at every step.

The Bottom Line: Keeping Your Practice Compliant and Your Patients Happy

Running a successful independent practice or urgent care center is no small feat, but ensuring that your patients aren’t hit with surprise bills is one of the easiest ways to improve their overall experience and keep them coming back. By focusing on Insurance Eligibility, Verification, and Estimation, you can protect your practice from compliance issues and avoid the financial chaos that comes with balance billing.

In the long run, it’s not just about preventing billing headaches. It’s about building trust and providing a transparent, patient-friendly financial experience that keeps your patients happy—and keeps your practice on the right side of the law. So, let’s make sure your patients know exactly what they’re paying for—before they ever walk through your door.

Ready to Simplify Compliance?

Navigating the complexities of the No Surprises Act doesn’t have to be overwhelming.

At CERTIFY Health, we’ve been working closely with practices like yours to ensure compliance while building trust with patients. From eligibility checks to cost estimation and beyond, we offer tailored solutions that align with your practice’s needs.

Let us show you how we can help you streamline your processes and provide a transparent, patient-friendly billing experience. Schedule a demo today and take the first step toward hassle-free compliance.