The No Surprises Act: Understanding About the Price Transparency and Compliance

The No Surprise Act came into effect on January 1, 2022, to protect patients against surprise medical bills. This Act guarantees that your patients will not have to pay additional, costly expenses if they receive emergency care or unknowingly receive out-of-network care in an in-network hospital. Rather, they will pay only for in-network services; the remainder is covered by insurance.

The NSA or No Surprise Act is a federal law made to address “surprise medical bills,” which means that practices should offer patients a clear picture of medical bills before they receive care. This is advantageous since it controls invoicing, protects revenue, and encourages patient trust.

In 2025, the goal of this rule is to simplify your practice’s difficulties and give patients a financial experience that is as simple as the care you offer, not only to ensure compliance. We’ll discuss the No Surprise Act’s implications for your practice, the importance of procedures like eligibility checks, verification, and cost estimation, and how you may use compliance as a chance to improve patient relations.

Pressed for time? That’s okay—just jump to the bottom of this article to connect with us at CERTIFY Health. We’ll guide you through each stage so you can focus on what matters most: growing your practice and offering top-notch care. To begin, let’s review the No Surprise Billing Act.

What is the No Surprises Act (NSA)?

The No Surprise Act was created to protect patients from unexpected medical costs. Although it might look like this law is only for patients but for practices like yours, this new unexpected medical bills law brings both opportunities and challenges in managing Insurance Eligibility Verification and Insurance Estimation.

Insurance verification and insurance estimation is an essential process for both maintaining legal compliance as well as making patients aware of their financial obligations before they ever leave your office. Let’s break this procedure down into steps to better understand: What makes them so crucial, and how can they aid in avoiding balance billing or surprise billing in urgent care and independent settings?

But before we do this, let’s first understand how the rule works, what it is, and why it is important for healthcare practices.

What is the Rule of No Surprises?

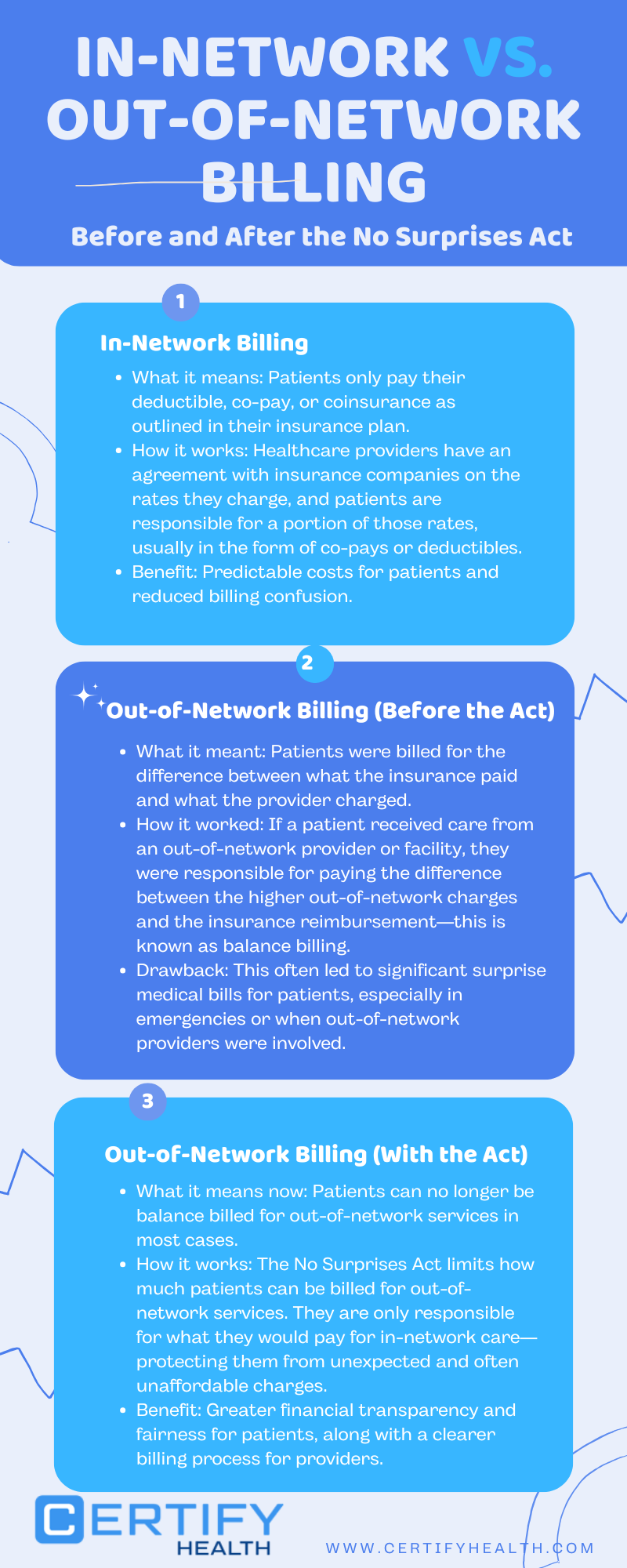

To put it simply, individuals who obtain emergency care at an in-network hospital but receive out-of-network services cannot be balance billed under the NSA No Surprise Act rule. Here’s what it covers:

- Emergency Services: Whether a physician or a hospital is in-network or out-of-network, patients cannot be charged more than they need to for emergency treatment.

- Non-Emergency Services: Out-of-network providers must adhere to in-network cost-sharing guidelines at in-network institutions.

- Good-Faith Estimates: Patients must be fully aware of their medical costs prior to receiving care so that there are no disputes over unexpected expenses and payment issues are solved upfront.

For practice, what does it mean? This rule is made to emphasize the importance of clear communication with patients and the need for accurate cost estimations. It’s not just about avoiding penalties—it’s about providing seamless and patient friendly experience to your patients while maintaining your revenue cycle.

Now let’s go into the deeper explanation:

What is the Rule of No Surprises?

The Consolidated Appropriations Act, 2021, which was approved by Congress and signed into law by then-President Donald Trump in December 2020, included the No Surprises Act. But the Act came into effect on Jan 1, 2022.

Overseen by the Centers for Medicare & Medicaid Services (CMS), the law continues to guide practices in 2025 as they refine processes for insurance eligibility, verification, and cost estimation.

Did You Know ?

As per one survey, the No Surprises Act (NSA) protected Americans from over 10 million surprise medical bills, as reported by AHIP and the Blue Cross Blue Shield Association.

This underscores the importance of regulatory compliance for practices.

By adhering to regulations, practices can avoid legal risks, build patient trust, and ensure timely reimbursements, ultimately improving their financial health and patient satisfaction. A high regulatory compliance rate is key to maintaining smooth operations and protecting both patients and providers from costly mistakes.

What Is NSA Surprise Billing and Why Does It Matter for Independent Practices?

Surprise medical billing was a common problem where patients were billed for the difference between the insurance coverage and the provider’s charges. Although it is a prevalent problem in emergency care, it can also impact non-emergency services in urgent care centers and independent medical offices. The patient may unexpectedly incur additional costs if the provider is out-of-network.

Here’s the tricky part: NSA surprise billing is prohibited under most emergency services and non-emergency services provided by out-of-network providers at in-network facilities. But for independent physician practices and urgent care centers that operate outside of hospital networks, therefore, the rules around balance billing can feel a bit murkier.

In your practice, if a patient receives care from an out-of-network provider or facility, and they don’t have the right information upfront, it could lead to these surprise medical bills.

Impact on Practices:

Non-compliance to NSA No Surprise Act pose serious financial challenges for small practices because they have no resources to navigate the process of Independent Dispute Resolution (IDR) and so they cannot ensure fair compensation.

Another reason why NSA matters is that it helps practices to understand billing in a better way and avoid financial loss by implementing the NSA rules effectively.

The No Surprise Billing Act helps practices build patient trust and loyalty by ensuring they receive medical care without facing surprise medical bills.

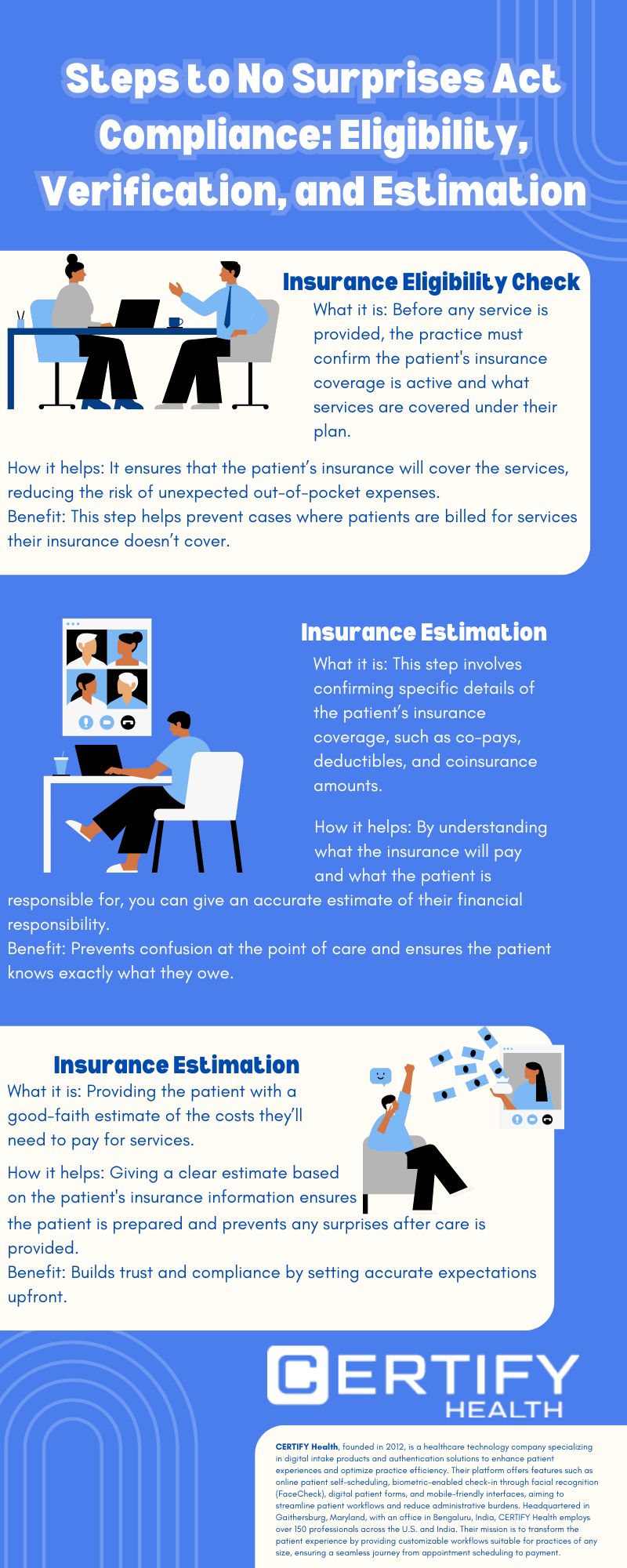

No Surprise Act Insurance Eligibility: The First Line of Defense

Before anything else, you need to know whether the patient’s insurance is valid and active. Think of Insurance Eligibility as the first line of defense against suffering from no surprise medical bill act. You may prevent situations where a patient goes into your practice and is later shocked to learn that their coverage doesn’t extend to specific services by making sure their plan covers the service they’re looking for.

Eligibility checks assist urgent care facilities and independent physician practices in determining whether the insurance company will pay for the treatments your patient need. You can identify the problem early on and assist the patient in finding other payment choices or a suitable course of action if their insurance does not cover the service or is not active. This simple step can prevent NSA surprise billing headaches down the line.

Learn how to boost your practice’s revenue by exploring our insights on Medical Insurance Eligibility Software.

Insurance Verification: Making Sure You Have the Full Picture

The next step is verifying the patient’s insurance details. This is done to identify whether the patient has active coverage and, if so, what is covered and what is not covered (out-of-pocket expenses). Because co-pays, deductibles, and coinsurance may vary based on the plan, this step is essential. For instance, some tests or treatments may not be covered, but an urgent care visit may be covered.

When your practice has a clear picture of patients’ insurance, you can do accurate billing and minimize the risk of balance billing. Doing so will help in practices understand if their patient understands the cost before receiving care and if there is any confusion, it can be resolved in advance.

For a deeper dive into the latest tools enhancing insurance verification, check out our article on 7 Top Insurance Verification Software Transforming Healthcare in 2025.

CERTIFY Health’s insurance verification software helps practices verify insurance eligibility of the patient in real-time and offer accurate insurance estimations to enhance patient trust. Connect with us to learn how our solutions can benefit your practice.

Insurance Estimation: Giving Patients a Clear Financial Picture

After eligibility and verification, it’s time for Insurance Estimation. Giving your patients an good-faith estimate of their debt will help you maintain compliance with the No Surprise Act while also establishing patient confidence. Since independent practices and urgent care facilities serve patients with different insurance plans and demands, providing an estimate that is clear and accurate is essential to building trust.

Your quotation shows what the insurance will pay and what the patients must pay out-of-their-pocket, be it a co-pay, deductible, or coinsurance. In some cases, you need to explain to your patients about charges like – out-of-network services for their clear understanding of the overall bill. Giving quotation and explanation of the bill upfront, before service, prevents distrust and prevents balance billing.

Bringing it all together, here’s a step-by-step process to ensure compliance with the No Surprise Medical Bill Act and simplify billing for both your practice and your patients.

How These Procedures Work Together to Protect Against Non-Compliance to Surprise Medical Billing Law

When these processes—insurance eligibility, verification, and estimation—work together, you not only help your practice stay compliant with the No Surprise Act Bill, but you also protect your patients from unexpected out-of-pocket costs. Here’s a quick rundown of how it all fits together:

- Eligibility – insurance eligibility checks for valid patient insurance and benefits covered.

- Verification – insurance verification allows collection of accurate insurance details and determination of patient’s co-pays, deductibles, and coverage limits.

- Estimation – it is a quotation that practices have to give patients upfront, before rendering services to ensure they accurate picture of their financial responsibility, reducing confusion and frustration.

These steps allow you to avoid surprise medical billing, stay transparent with your patients, and keep them satisfied with their experience at your practice.

Ensure compliance and patient satisfaction with CERTIFY Health’s comprehensive insurance verification services. Discover more.

What are the Key Points of the No Surprises Act?

Let’s break down the essentials of the Surprise Medical Billing Law. Now, here’s what you need to know:

- Balance Billing Prohibition: Patients can’t be balance billed for emergency services or non-emergency services provided by out-of-network providers at in-network facilities. This is to ensure patients aren’t caught off guard by unexpected charges.

- Good-Faith Cost Estimates: Providers are now required to share clear, detailed cost estimates with patients before care is delivered, eliminating any financial surprises.

- Independent Dispute Resolution (IDR) Process: When billing disagreements arise, providers and insurers can resolve them through a federal arbitration process—keeping patients out of the middle.

- Transparency in Coverage: Patients must be informed about their insurance coverage, including network status and cost-sharing details, so they know exactly what to expect.

These key points aren’t just about compliance—they’re about building trust with your patients and creating a billing experience that’s as transparent as the care you provide.

For more insights, check out the ACEP overview of the No Surprises Act.

Insights:

Significant Takeaways Learned from the No Surprises Act: The No Surprises Act emphasizes openness in healthcare coverage, shields individuals from unforeseen expenses, mandates good-faith cost estimates, and arbitrates disputes. See the ACEP overview for further information.

Does the No Surprises Act Apply to Physician Offices?

For physician offices, the applicability of the No Surprises Act can seem less straightforward compared to hospital-based services. However, the Act does apply in specific scenarios, particularly when non-emergency and out-of-network services are involved.

According to CMS, if a physician office provides out-of-network services in a manner that triggers surprise billing, the Act’s protections come into play. This includes scenarios where a patient has limited visibility into their network options beforehand.

In order to guarantee compliance and prevent disagreements, the American Medical Association emphasizes the significance of taking proactive steps, such as confirming insurance eligibility and offering thorough cost estimates. This entails policies incorporating strong mechanisms for cost estimation and insurance verification to guarantee patients are aware of their financial obligations prior to treatment.

Adhering to these guidelines, physician offices not only comply with the Act but you also enhance patient trust by offering transparency at every step.

The Bottom Line: The No Surprises Act Summary

Running an urgent care center or an independent practice comes with its own set of challenges and the No Surprise Act adds up to this. But you don’t have to worry, you can avoid surprise bills by streamlining your operations and billing process.

You need to prioritize insurance eligibility, verification, and estimation process to sidestep compliance issues and the pitfalls of balance billing.

Ultimately, it’s about more than just smooth billing; it’s about building trust among your patients and offering a smooth & transparent financial experience. Ensure your patients understand their costs before they arrive, paving the way for a positive relationship.

Ready to Simplify Compliance?

Navigating the complexities of the No Surprises Act doesn’t have to be overwhelming.

At CERTIFY Health, we have built a platform that helps you streamline your front-desk operations and ensure secure and transparent upfront billing so that your patients don’t have to face surprise medical bills. For your practice, this means compliance with the NSA. From eligibility checks to cost estimation and beyond, we offer tailored solutions that align with your practice’s needs.

To learn more Schedule a demo today and take the first step toward hassle-free NSA compliance.