Table of Contents

Introduction

Why Real-Time Insurance Verification is a Game-Changer in 2025

Claim denials are a major headache for healthcare providers, leading to annual $25 million in lost revenue. Yet, many practices still rely on outdated, manual insurance verification—wasting hours, frustrating staff, and creating endless back-and-forth with insurers just to get paid.

The result? Burnout, inaccurate insurance verifications, delayed reimbursements, and revenue leakage. Your administrative team shouldn’t have to chase insurance details when they could be focusing on patient care.

A cutting-edge technology like CERTIFY Health’s real time insurance eligibility verification software streamlines claim approvals, automates eligibility checks, and promptly finds co-pays and deductibles, all of which help your practice increase cash flow while reducing staff stress.

Did you know?

As of late 2024, approximately 83% of healthcare practices still primarily rely on traditional front desk check-ins, with only 7% having fully embraced online check-in options.

The Revenue Leakage in Healthcare

Manual insurance verification costs you more than automated insurance eligibility verification. This is because your administrative staff spends plenty of time and resources on the procedure. A study revealed that healthcare practices using the manual method cost $3.59 more per claim.

The financial viability of healthcare is especially threatened by claim denials. About 20% of all claims are rejected for eligibility reasons, which results in a significant amount of rework, delayed payments, or total write-offs.

Each denied claim sets off a chain reaction of operational and financial issues that take up important staff time to fix and could if left unchecked, result in permanent revenue loss.

The effects go beyond only the obvious financial ones. Uncertainty about one’s coverage status or potential out-of-pocket costs significantly increases the number of last-minute cancellations and patient no-shows. Due to this uncertainty, patient scheduling becomes ineffective and missed appointment times cannot be recovered.

Employees must spend hours on hold or navigate complex payer portals while pursuing insurance companies for verification, which adds to their workload.

In addition to delaying treatment and lowering patient satisfaction, this administrative overload also fuels the pervasive burnout growing among medical staff.

Revenue leakage in healthcare industry threatens the entire care delivery model. This is a systemic problem that goes beyond wasted money.

Why Manual Insurance Verification Fails Healthcare Providers

Time-Consuming Phone Verification

To verify coverage for a single patient, staff frequently spend several hours calling payers, battling automated phone systems, or hopping between several payer portals. Such a time-wasting process takes up valuable staff time and incurs delays in patient registration and scheduling.

High Error Rates

Manual insurance verification processes are highly prone to human error, from mistyped policy numbers to incorrectly documented benefits. These seemingly minor mistakes can have major financial consequences.

A single insurance verification error can result in weeks of claim rework, causing serious financial strain for healthcare providers who must maintain cash flow while waiting for resolution.

Dangerous Timing Gaps

Most manual verifications occur days or even weeks before appointments, creating a dangerous gap where coverage can change without the provider’s knowledge.

By the time the patient arrives for service, their insurance status may have changed completely, leading to unexpected denials and complicated billing scenarios.

This temporal disconnect represents one of the fundamental flaws in traditional verification methods.

Inefficient Resource Allocation

In the rapidly evolving healthcare industry of 2025, where staffing shortages are common, investing valuable human resources in tasks that may be automated is a huge opportunity cost.

Instead of concentrating on basic verification tasks that technology can perform more effectively, administrative staff should better serve patients by concentrating on other value focused tasks.

Patient Experience Deterioration

For patients, the inefficiencies of manual insurance verification create friction points throughout their healthcare journey.

Unclear financial expectations lead many to postpone or cancel appointments entirely when they’re uncertain about their coverage. This hesitation not only impacts provider revenue but can also lead to delayed care and poorer health outcomes.

Financial Unpredictability

Without real time insurance eligibility verification (RTIEV), healthcare organizations face unpredictable revenue cycles. The delay between service delivery and payment confirmation creates financial uncertainty that complicates business planning and investment decisions.

Modern healthcare organizations require financial predictability that only automated verification can provide.

The Solution: Real Time Insurance Eligibility Verification Through Automation

The path to financial stability starts before care is delivered. For many providers, revenue loss begins at scheduling when insurance uncertainty causes friction. Real-time eligibility verification solves this by instantly confirming patient benefits, preventing costly delays and claim denials.

Automated verification transforms a time-consuming task into a seamless process. It boosts patient conversion, enhances financial stability, and reduces administrative strain.

How does it stop revenue leakage in healthcare? First, it provides instant coverage validation, reducing no-shows and last-minute cancellations due to cost concerns. Patients and providers gain clarity on financial responsibilities upfront.

Second, it accelerates payment collection. Staff can confidently request co-pays, co-insurance, or deductible payments during check-in—eliminating billing surprises and delays.

Most importantly, real-time verification prevents claim denials. By ensuring accurate, up-to-date insurance details, providers submit error-free claims on the first attempt, improving cash flow and reducing costly rework.

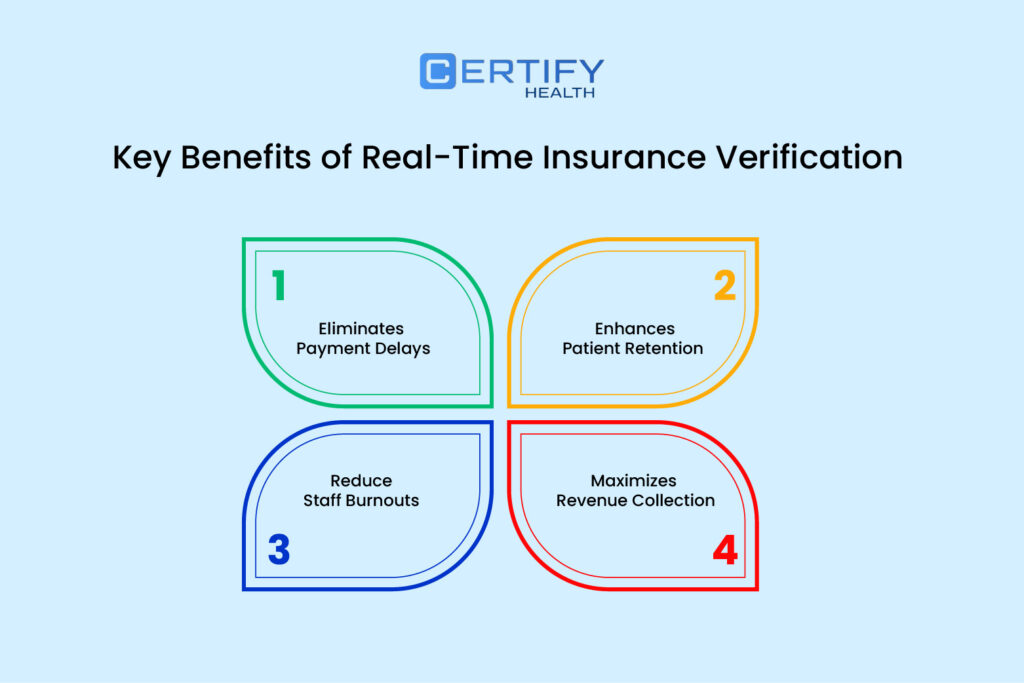

Key Benefits of Real-Time Insurance Eligibility Verification

Maximizes Revenue Before Service

Real time insurance eligibility verification shifts financial clearance to the pre-service phase. By confirming coverage instantly, providers prevent revenue loss from unreimbursed services and ensure claims are submitted correctly, reducing denials and boosting cash flow.

Automated verification also increases upfront payments. Staff can confidently discuss financial responsibilities, provide accurate cost estimates, and collect payments before patients leave—minimizing outstanding balances and follow-ups.

Speeds Up Reimbursements & Eliminates Delays

Integrating real time insurance eligibility verification with billing streamlines the revenue cycle, enabling faster, more accurate claim submissions. This significantly cuts accounts receivable days and speeds up reimbursements.

Error-checking automation prevents disputes that cause delays. Providers avoid long adjudication processes by resolving issues before claim submission, ensuring predictable cash flow and better financial planning.

Enhances Patient Trust & Reduces Drop-offs

Today’s patients expect cost transparency. Real-time verification ensures they understand their coverage and out-of-pocket costs upfront, increasing trust and treatment adherence.

Financial clarity makes patients less likely to cancel last-minute or skip appointments. Practices using automated insurance eligibility verification process report fewer no-shows, protecting revenue while improving patient outcomes.

Reduces Staff Burnout & Administrative Load

Insurance verification is a major administrative burden. Automating this process frees staff from tedious calls and paperwork, allowing them to focus on patient care.

With fewer manual tasks, teams operate more efficiently without increasing headcount. This reduces burnout and improves job satisfaction, helping retain skilled staff and maintain workflow stability.

How CERTIFY Health Helps Healthcare Providers Maximize Revenue

Automated Verification at Check-In

CERTIFY Health’s insurance verification software leads the industry with its seamless check-in process that automatically initiates eligibility checks as patients arrive for their appointments.

This system integrates with existing practice workflows to verify coverage in real-time, preventing the disruptive scenario where patients discover insurance verification issues after they’ve already committed time to an appointment.

By confirming real time insurance eligibility before service, healthcare providers avoid the awkward and potentially damaging experience of surprise coverage denials.

User-Friendly Interface

The platform’s user-friendly interface makes the verification process transparent for staff and patients.

Digital verification results are presented in clear, actionable formats that allow front desk personnel to quickly determine coverage status without needing specialized training in insurance terminology.

This accessibility ensures that even new staff members can confidently manage the verification process during their first day of work.

EHR & Billing Integration for Instant Claims Processing

One of CERTIFY Health’s most powerful features is its seamless integration with existing electronic health record (EHR) systems and billing platforms.

This interoperability eliminates the data silos that typically plague healthcare revenue cycles, creating a continuous information flow from appointment scheduling through service delivery and claim submission.

When real-time insurance eligibility verification is integrated with clinical and billing systems, the entire revenue cycle gains efficiency.

Insurance information verified at check-in automatically populates billing forms, reducing data entry errors and accelerating claim submission.

This integration minimizes payment disputes by ensuring that all claims contain accurate, up-to-date insurance information that has been verified directly with the payer.

Pre-visit Payment Options & Compliance Handling

CERTIFY Health’s real time insurance eligibility verification platform transforms financial conversations with patients by providing accurate estimates of out-of-pocket costs based on real time insurance eligibility data.

These transparent financial discussions enable providers to collect payments upfront or establish payment plans before services are rendered, dramatically improving collection rates and reducing accounts receivable.

The platform offers flexible payment options that accommodate various patient preferences, from traditional methods to digital payments.

This versatility makes it easier for patients to fulfill their financial obligations while ensuring that providers capture revenue at the optimal moment—when the patient is physically present and has just received care.

Importantly, all these financial transactions occur within a HIPAA-compliant framework that protects sensitive patient information.

CERTIFY Health’s robust security protocols maintain the confidentiality of both health and financial data, giving providers and patients peace of mind throughout the verification and payment process.

Scalable for All Specialties

The versatility of CERTIFY Health’s insurance verification software makes it suitable for healthcare organizations of all sizes and specialties.

Whether it’s a hospital system managing thousands of daily encounters, a dental practice with unique coverage requirements, or a specialty clinic dealing with complex authorization needs, the platform adapts to specific verification workflows.

This scalability ensures organizations can implement automated insurance eligibility verification without disrupting existing operations.

The system grows with practice, accommodating increasing patient volumes and expanding payer relationships. For multi-specialty groups, the platform can be customized to address the specific insurance verification requirements of different departments, creating a cohesive revenue cycle approach across diverse clinical areas.

Future-Proofing Healthcare Finances in 2025

Financial efficiency is as crucial as clinical excellence. Real-time insurance eligibility verification prevents revenue leakage in healthcare, accelerates cash flow, and enhances patient financial experiences.

Providers using automated insurance eligibility verification see fewer claim denials, faster reimbursements, and higher point-of-service collections. As payer requirements grow more complex, manual processes can no longer keep up.

CERTIFY Health’s real time insurance eligibility verification software empowers providers to streamline operations, boost revenue, and enhance patient trust.

Book a Demo with CERTIFY Health to invest in an automated solution that ensures long-term financial stability and quality care.