Table of Contents

Introduction

The difference between financial stability and revenue loss for healthcare organizations often hinges on a single process: patient insurance eligibility verification. When healthcare facilities fail to accurately verify coverage, the fallout affects everything from the bottom line to patient satisfaction.

Recent statistics paint a sobering picture: hospitals lose an average of 3.3% of net patient revenue due to claim denials—approximately $4.9 million per facility annually. Each denied claim requiring resubmission costs around $118 in administrative work, further straining already limited resources.

These statistics highlight the increasing demand for automation in eligibility verification to streamline healthcare operations and prevent avoidable claim denials.

In this blog, we will address the common challenges healthcare providers face in patient insurance eligibility verification and provide five proven strategies to ensure 100% accuracy. Also, we will explore how technological solutions like CERTIFY Health can transform verification processes while improving patient experience and revenue capture.

The Evolving Challenges of Verification in Today's Healthcare Environment

TL; DR:

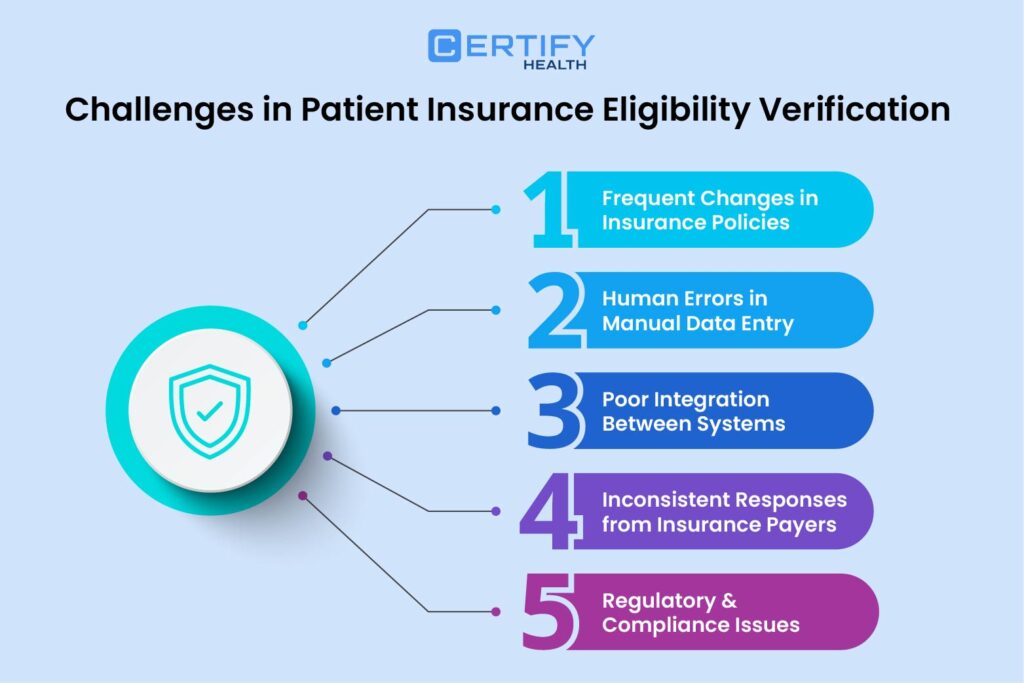

Key Challenges in Insurance Verification

- Constantly changing insurance policies → Patients switch plans, payers update terms, causing frequent errors.

- Manual data entry risks → Small mistakes at registration snowball into costly claim denials.

- Disconnected systems → Lack of integration creates data silos and outdated information.

- Inconsistent payer responses → Varying formats, delays, and unclear terminology add complexity.

- Regulatory pressure → Laws like the No Surprises Act + HIPAA compliance raise verification stakes.

Constantly Changing Insurance Policies

The most persistent headache in patient insurance eligibility verification comes from the constantly shifting landscape of insurance policies. Patients frequently switch plans or carriers without informing their providers, creating verification nightmares for administrative staff. Meanwhile, insurance payers continuously update their terms, introducing new coverage limitations and requirements that blindside even the most vigilant billing departments.

The No Surprises Act and other regulatory changes have added layers of complexity to the verification process. With facilities treating significantly more patients than five years ago, keeping pace with evolving insurance details while maintaining accuracy has become increasingly difficult.

The Hidden Costs of Manual Data Entry

Despite technological advances, manual data entry remains deeply embedded in verification workflows at many facilities. This human element introduces substantial error risks. Something as simple as entering “Rob” instead of “Robert” can trigger a cascade of problems ultimately resulting in denied claims.

It is noted that eligibility issues begin upstream during registration when patient information collected is either wrong or incomplete. When staff members are rushed—as they frequently are—these manual data entry mistakes multiply, compromising the entire claim submission process and damaging the organization’s financial health.

System Disconnects and Poor Integration

Most healthcare organizations operate multiple systems that don’t effectively communicate. This poor integration creates troublesome data silos that severely hamper accurate verification of patient eligibility. Updated information in one system often fails to reflect in another, creating inconsistencies that lead to claim denials.

Without real-time updates across platforms, staff frequently work with outdated insurance details, making accurate verification nearly impossible. These disconnected systems introduce numerous failure points throughout the revenue cycle where errors can occur and compound.

Wrestling with Inconsistent Responses from Payers

Anyone who’s worked in healthcare billing knows the frustration of dealing with inconsistent responses from insurance payers. Each carrier seems to use its own unique format and terminology, making standardization virtually impossible. This inconsistency forces administrative staff to become interpreters of various payer languages, adding complexity to an already challenging process.

Delays in payer response times further complicate matters, forcing providers into an uncomfortable position: proceed with treatment without confirmed coverage or postpone care while awaiting verification. Neither option is ideal, and both carry financial implications.

Navigating the Regulatory Minefield

Accurate verification of patient eligibility doesn’t happen in a vacuum—it occurs within a highly regulated environment where compliance issues can result in severe penalties. Organizations must navigate HIPAA requirements while also adhering to specific payer protocols.

Verification processes must maintain the security and privacy of patient information, adding another layer of complexity. With regulatory issues frequently changing, providers must constantly monitor and adjust their verification procedures to remain compliant and avoid costly penalties.

Read Our Comprehensive Guide on: Real-Time Insurance Eligibility Verification: How Healthcare Providers Can Maximize Revenue & Efficiency in 2025

5 Essential Strategies for Foolproof Insurance Eligibility Verification

TL; DR:

What are the best practices to ensure accurate patient insurance verification?

Here are the 5 best practices to ensure accurate patient insurance verification:

- Pre-Visit Checks: Collect patient & insurance info 1–2 days early; use a checklist to avoid errors.

- Automate Verification: Real-time digital tools reduce manual work and speed up workflow.

- Patient Communication: Reminders and digital forms improve accuracy and transparency.

- Claims & Payments: Connect verification to claims and calculate patient responsibility upfront for faster reimbursements and fewer disputes.

1. Pre-Visit Insurance Verification (1-2 Days Ahead of Appointment)

The foundation of accurate patient insurance eligibility verification begins well before the patient arrives. By gathering comprehensive patient details in advance (1-2 days before their they walk-in), your team can identify and resolve discrepancies before they evolve into costly problems.

Essential information to collect includes:

- Complete patient details: Full legal name, birth date, current address, contact information, and relationship to the policyholder

- Thorough insurance details: Policy and group numbers, insurer name, and plan type

- Verification of insurance validity: Coverage start and end dates to confirm active status

Practices that implement pre-visit information collection experience substantial benefits:

- Dramatically reduced wait times at check-in

- Fewer last-minute scrambles to correct missing details, discrepancies, or any prior-auth needs.

- Enhanced patient satisfaction through streamlined administrative processes

Healthcare practices can reduce eligibility related claim denials by simply implementing CERTIFY Health’s patient scheduling software and patient intake solution for easy gathering of patient information.

Pro Tip:

Create a verification checklist. Build a step-by-step guide that captures every critical detail—policy numbers, co-pays, deductibles, coverage for key CPT codes, and prior authorization needs. A standardized checklist keeps your team aligned, reduces human error, and ensures no essential information slips through the cracks.

2.Automate Patient Insurance Eligibility Verification

The days of manual insurance verification calls should be firmly behind us. Automated insurance verification represents a quantum leap in how providers approaches this critical process. Modern solutions like CERTIFY Health’s unified healthcare platform enable real-time insurance verification that helps verify insurance instantaneously with insurance payers, eliminating the delays and errors inherent in manual processes.

Here’s how effective real-time insurance verification works:

- Patients provide insurance information through digital channels

- Automated systems immediately check coverage details with payers

- Staff receive instant verification results, allowing them to address issues before services are rendered

The benefits extend beyond accuracy:

- Significant reduction in staff workload and burnout

- Virtual elimination of manual entry errors

- Accelerated workflow with same-day verification for all appointments

As patient volumes grow, automated real-time insurance verification becomes not just preferable but essential for maintaining both efficiency and accuracy.

3. Transform Your Patient Communication Strategy

The verification process improves dramatically when patients become active participants rather than passive subjects. Strategic efforts to improve patient communication simplify insurance eligibility verification by ensuring patients understand what information is needed and why it matters.

Effective communication methods include:

- Sending personalized, timely reminders about completing insurance information before visits

- Implementing user-friendly digital forms that guide patients through providing necessary details

- Educating patients about the importance of updating their information when changes occur

- Modern technology solutions enhance these communication efforts by:

- Automating the reminder process without adding to staff workload

- Reducing the administrative burden of phone follow-ups

- Creating a more transparent financial experience for patients

CERTIFY Health’s patient communication platform help practices improving patient communication regarding insurance information, reducing eligibility-related denials and improving operational efficiency.

4. Refine Your Claim Submission Process

Accurate patient insurance eligibility verification lays the groundwork for successful claim submission. When verification is thorough and precise, the entire claim processing workflow flows more smoothly, resulting in fewer denials and faster reimbursement.

Key benefits of verification-focused claim processing include:

- Significantly higher first-pass acceptance rates for submitted claims

- More predictable cash flow due to fewer delayed or denied reimbursements

- Reduced staff time spent on claim resubmissions and appeals

By connecting verification directly to claim submission, providers create a seamless workflow that catches errors before they become costly problems. This integration transforms patient insurance eligibility verification process from a standalone administrative task into a strategic financial process.

5. Revolutionize Your Payment Collection Approach

Perhaps the most tangible benefit of accurate patient insurance eligibility verification process is the ability to determine patient financial responsibility upfront. When patients understand their payment obligations before receiving care, both payment collection and satisfaction improve dramatically.

Benefits of verification-informed payment collection include:

- Greater transparency regarding out-of-pocket expenses

- Increased point-of-service collections

- Reduced billing confusion and payment disputes

- Improved overall cash flow for the practice

- Advanced verification solutions help by:

- Calculating patient responsibility based on verified insurance information

- Facilitating easier payment collection at time of service

- Integrating verification data directly with payment systems

Pro Tip

Onboard digital solutions like CERTIFY Health that help you determine patients’ financial responsibility upfront with its pre-registration insurance verification tool. You can collect insurance details during pre-registration from your patients before they have even walked into your practices; it ensures 100% accurate eligibility verification results, improves point-of-service collections and reduces bad debts.

Bonus Tips for Accurate Patient Insurance Eligibility Verification:

- Make Data Easy to Use

Present insurance details in a simple, user-friendly format so staff can verify coverage quickly and accurately. For self-pay patients, use real-time financial counseling to set clear expectations and reduce payment delays. - Keep Staff Sharp

Ongoing training ensures staff stay up-to-date on insurance rules, verification workflows, and technology tools. Well-trained teams make fewer errors and keep your revenue cycle running smoothly. - Audit Your Process

Don’t just set it and forget it. Regular audits help catch errors, confirm that checklists are being followed, and highlight opportunities to improve efficiency and compliance.

Transforming Verification Through Technology

Modern insurance verification software addresses many of the challenges discussed above. Solutions like CERTIFY Health’s insurance verification software offer comprehensive approaches to patient insurance eligibility verification that leverage automation to ensure real-time accuracy with minimal staff intervention.

Our platforms integrate seamlessly with existing systems like Electronic Health Records (EHR) and Practice Management Systems (PMS) while offering:

- Automated eligibility checks that virtually eliminate manual errors

- HIPAA-compliant verification processes that maintain data security

- Streamlined workflows that reduce administrative burden

Healthcare organizations choose advanced insurance verification software for compelling reasons:

- Substantial reduction in administrative costs

- Dramatically increased claim approval rates

- Enhanced operational efficiency

- Improved patient financial experience

Conclusion: The Critical Path Forward

Accurate patient insurance eligibility verification serves as the cornerstone of a healthy revenue cycle. By implementing the five strategies outlined in this article, healthcare providers can significantly improve their verification processes:

- Collect comprehensive patient information before visits

- Implement real-time insurance verification technology

- Enhance patient communication about insurance information

- Streamline claim submission through accurate verification

- Optimize payment collection by identifying financial responsibilities upfront

As healthcare continues to evolve with increasingly complex insurance arrangements and regulatory issues, investing in robust patient insurance eligibility verification processes becomes not just important but essential.

Modern verification solutions offer healthcare providers the tools to transform this critical process, reducing claim denials, decreasing administrative burdens, and ensuring financial stability.

By prioritizing patient insurance eligibility verification, healthcare organizations can protect their revenue while simultaneously improving the patient experience—truly a win-win scenario in today’s challenging healthcare environment.

Next Step! Read Our Blog on: 7 Top Insurance Verification Software Transforming Healthcare in 2025 Or Book a Personalized Demo.

FAQ'S

How to check patient insurance eligibility?

Eligibility can be checked in several ways:

- Manually by calling the payer or using IVR systems

- Electronically through payer portals

- Automatically via integrated software and clearinghouses.

The most efficient option is real-time electronic verification, where patient data is instantly validated against the insurer’s database. This approach reduces errors, saves staff time, and provides quick confirmation of coverage, co-pays, deductibles, and authorization requirements.

How to verify insurance eligibility and benefits?

Verifying eligibility and benefits involves confirming both that coverage is active and what specific services are included.

Along with basic details like coverage dates, pay close attention to co-pays, deductibles, out-of-pocket limits, and whether certain procedures require prior authorization.

This step ensures patients receive accurate cost estimates upfront and prevents claims from being denied for uncovered services.

How insurance verification improves patient intake efficiency?

When insurance verification happens before the patient arrives, the intake process becomes much faster and smoother.

Staff don’t waste time scrambling for missing details at check-in, and patients aren’t stuck filling out endless forms or waiting on hold with insurers.

The result: shorter wait times, fewer errors, and a more professional, stress-free experience for patients and staff alike.

What are the best practices for automating insurance verification for patients?

The key best practices for automating insurance verification include:

- Integrating automation directly into your scheduling and EHR systems

- Validating data at the point of entry

- Setting up real-time checks before every appointment.

- Automating reminders for patients to update their insurance information also helps prevent surprises.

- Most importantly, choose a platform that supports multi-payer verification so your staff isn’t juggling multiple systems.

How can technology improve insurance eligibility verification?

Technology transforms verification from a manual, error-prone task into a streamlined, reliable process. With automated tools, practices can instantly confirm coverage, calculate patient responsibility, and flag issues like authorization requirements, all in real time.

Beyond speed and accuracy, technology also reduces staff burnout, cuts down administrative costs, and builds patient trust by giving them transparency about their financial responsibility upfront.