Managing the revenue cycle in today’s healthcare landscape is more challenging than ever before. It involves effective management of finances to ensure a healthy bottom line. To tackle this challenge, healthcare providers rely on automated Revenue Cycle Management platforms. So, providers can streamline the financial processes for better operations using Revenue Cycle Management in Healthcare.

What is Healthcare Revenue Cycle Management?

To gain a clear understanding, revenue cycle management in healthcare starts as soon as your patient schedules an appointment, and it continues until you collect all outstanding balances from your patients. However, in some circumstances you may face challenges in payment collection due to:

- Insurance Fraud / Claim Denials

- Manual payment methods

- Regulatory Compliance

- Billing Errors

To tackle all the above challenges, implementing revenue cycle process in healthcare helps you automate most of these processes, leading to

- Improved patient satisfaction

- Data-driven decision making

- Cash flow optimization

- Reduced billing errors

- Increased revenue

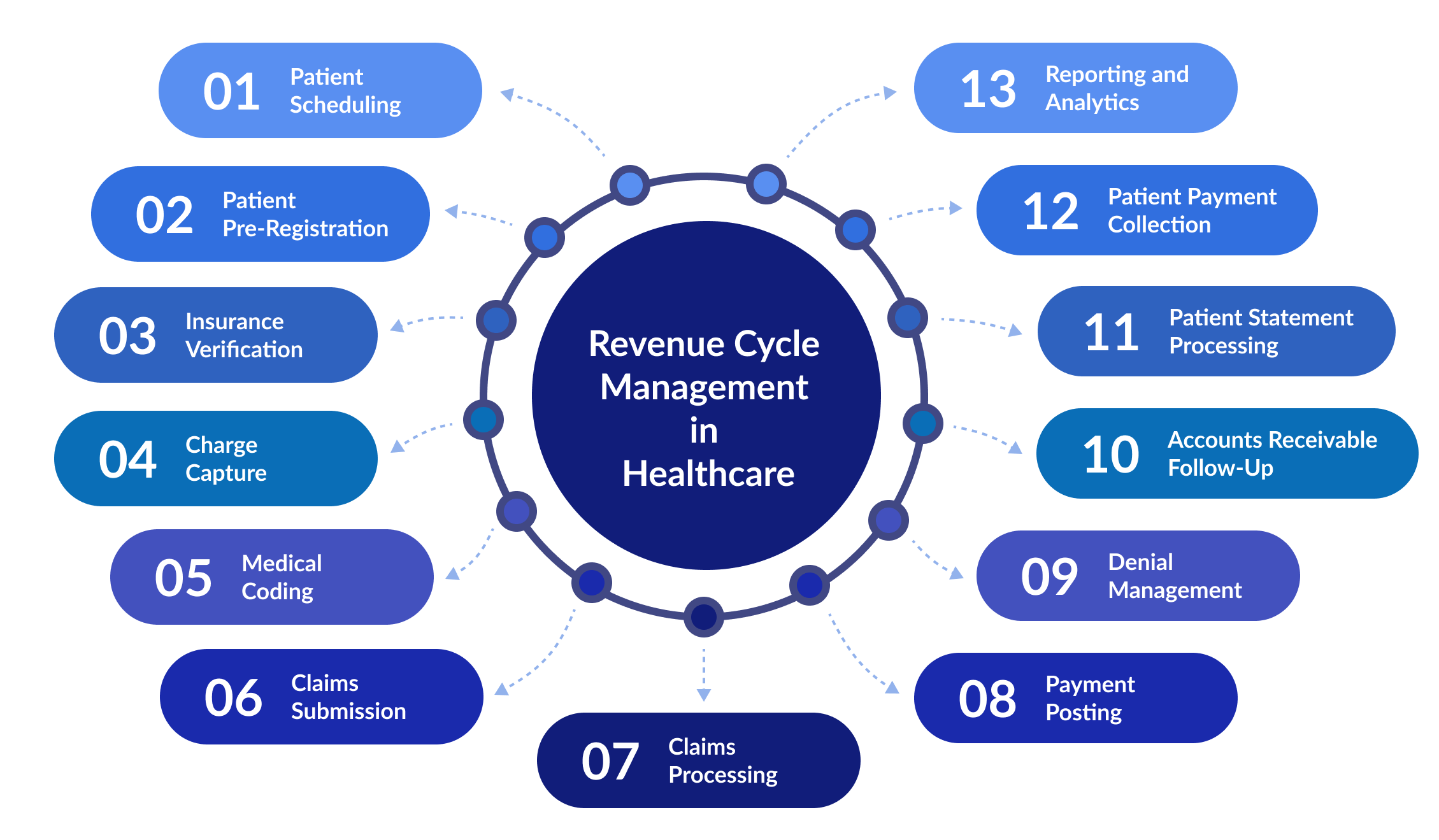

To get a clearer picture of what revenue cycle management does in healthcare, look at the 13 steps in the revenue cycle involved.

13 Steps in the Process of Revenue Cycle Management in Healthcare:

Step 1: Patient Scheduling

Patient Scheduling is a vital part of the revenue cycle, which when streamlined effectively, drives revenue to your practice. However, complicated authorization procedures and long wait times can frustrate patients, leading to their dissatisfaction.

Providers can reduce no-shows and boost revenue by prioritizing patients’ convenience and offering flexible appointment scheduling. Streamlined scheduling is possible with the CERTIFY Health platform, which keeps your patients engaged via automated appointment reminders to eliminate long wait times.

Step 2: Patient Pre-Registration

This step is always important, as it involves collecting the patient’s information before visiting your practice to expedite the check-in process. Here, the provider will collect the patient information, including:

- Name

- Medical History

- Payer Details

- Payment Modes

- Insurance Card

All the above data is collected prior to the patient’s first visit to the hospital. Pre-registration helps both the patient and provider save time.

Step 3: Insurance Verification (Eligibility and Benefits Verification)

Insurance verification in the revenue cycle management process involves confirming your patient’s insurance coverage and benefits to prevent claim denials and boost revenue flow. CERTIFY Health platform helps providers with instant insurance verification checks, eliminating bad debts and accelerating revenue flow. Our platform collects patient information, including:

- Patient’s insurance policy number

- Name of the insurance company

- The type of plan

After collecting the above information from patients, it is easy to calculate the co-pays and deductibles for the services availed by patients.

Step 4: Charge Capture

The charge capture involves the documentation of various services that you provide to your patients to send their charges to the insurance companies. This phase is important in healthcare revenue management to ensure that your practice gets complete payment from the patients’ insurance company for revenue integrity.

Step 5: Medical Coding

Medical coding should be accurate and up to date to get reimbursed for your services. In some conditions, the hospitals may receive denials for incorrect codes used in claim files. To tackle this situation, most healthcare providers prefer outsourcing to a medical billing company to handle denial management.

Step 6: Claims Submission

Another essential step of revenue cycle management in healthcare is claims submission. Providers should submit only accurate patient data to avoid slowing down patient payments from the insurance company.

Step 7: Claims Processing

Soon after you submit the claim documents, ensure you keep an eye on the process regarding any denials or rejections. It will help you to take immediate action to fix the claim denials.

Step 8: Payment Posting

Payment posting is the crucial step where the providers need to maintain a record of received payments from

- Insurance companies

- Third-party administrators

- Patients

Proper payment posting helps maintain accurate records of accounts receivable (AR), preventing discrepancies, reducing underpayments, and ensuring timely follow-up on outstanding balances. Efficient AR management impacts cash flow and financial stability of healthcare practices, making it essential to streamline payment posting.

Did you know?

The healthcare sector faces complex billing challenges, resulting in a 5-7 times annual turnover ratio (HFMA). Comparing your Accounts Receivable (AR) Turnover Rate can reveal inefficiencies or strengths, helping improve collections, credit control, and financial management.

AR Turnover Rate measures how efficiently a business collects payments. It is influenced by credit policies, billing accuracy, and collection processes. To improve it, businesses should streamline invoicing, set clear payment terms, and enhance follow-ups.

Step 9: Denial Management

Managing denials is another challenging part of your healthcare revenue cycle. Identifying the root cause of the denials helps healthcare providers to initiate the right steps to resolve them. But this process includes everything from analyzing coding practices to checking for medical necessities.

Step 10: Accounts Receivable Follow-Up

Following up on your patients’ accounts receivable is essential to increase the speed of payment collection. Payment reminders are the best way to follow up on any patient’s outstanding accounts receivable. CERTIFY Health streamlines the patient payment process by sending reminders to collect outstanding balances.

Step 11: Patient Statement Processing

Patient statement processing involves generating and sending financial statements to your patients. These statements provide a clear view for your patients regarding the payments they make, and the medical services rendered.

By ensuring transparent and timely communication of financial information, practices can build patient trust and streamline revenue collection processes.

Step 12: Patient Payment Collection

Providers can retrieve their payments from patients by offering them flexible payment options and payment plans.

To ease your patient payment collection, CERTIFY Health offers multiple payment methods and modes to ensure timely collection. Our platform makes it easy to create a win-win situation for patients and providers.

Step 13: Reporting and Analytics

The last step in the revenue cycle is vital, as it provides invaluable data insights to pinpoint trends and areas for enhancement. You can swiftly identify payment errors, voids, or refunds through thorough analysis, enhancing revenue management.

The Bottom Line:

In the dynamic healthcare landscape, mastering Revenue Cycle Management (RCM) is paramount for providers aiming to optimize financial performance and enhance patient care. By meticulously navigating through the 13 steps outlined above, healthcare practices can streamline processes, minimize errors, and maximize revenue potential.

CERTIFY Health is at the forefront of this transformative journey, offering innovative solutions to enhance PPM in healthcare. From seamless patient scheduling and pre-registration to automated insurance verification and payment collection, CERTIFY Health helps providers deliver exceptional patient experiences while ensuring financial stability.

Contact us now to know how our platform can boost your revenue and improve your patient experience.